A mortgage rate, often known as mortgage interest rate or interest rate, is part of the fees associated with borrowing money from a lender. Instead of paying a lump sum to your mortgage lender, you are required to pay interest as a part of your monthly mortgage payment.

How Do Mortgage Rates Work

Mortgage interest rates work very similarly to how other loan rates work. Your monthly payment to a lender is a predetermined portion of the total amount you borrow. The principal on a mortgage refers to the sum you must borrow to buy the house.

In other words, mortgage rates represent a portion of the credit that has been given to you. The overall cost of borrowing decreases with decreasing interest rates, and you pay less throughout your mortgage.

How Mortgage Rates Are Determined

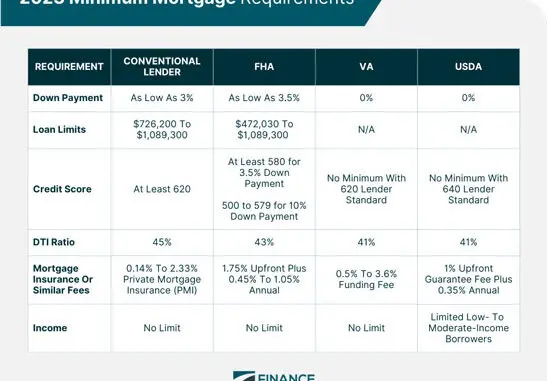

Multiple factors affect mortgage rates. The mortgage interest rates you could be eligible for greatly depend on your credit score. But when determining your mortgage rate, lenders also consider factors like the type of loan you select, how much you save up front, and the current interest rate environment.

Mortgage Rates Vs. APR

Your mortgage rate is a portion of the annual percentage rate (APR), which is an estimation. Therefore, your APR is often larger than your mortgage interest rate.

Your mortgage rates only include the cost of borrowing a specific amount from a lender. It is the actual rate used to determine how much principal and interest you must pay monthly. The APR includes a broader range of mortgage-related expenses, such as

- Broker fees

- Discount points

- A percentage-based part of your closing costs

Ask your lender what is included in the annual percentage rate (APR) and how the mortgage terms affect the amount before comparing APRs for various loans.

Types of Mortgage Rates

Your monthly interest rate depends on the period of your loan, how long it takes to pay it off, and the type of mortgage you get. Mortgage loans come in three main types.

Fixed Rate Mortgage

A fixed-rate mortgage gives you a fixed interest rate for your loan duration. Your monthly principal and interest payments would remain constant. The starting interest rate on an adjustable-rate mortgage is often lower than that of a fixed-rate mortgage.

Adjustable Rate Mortgage (ARMs)

How do adjustable mortgage rates work? An adjustable-rate mortgage (ARM) has an initial fixed interest rate that is fixed for a predetermined amount of time, such as 5 or 7 years, and may subsequently fluctuate over time. This implies that your monthly principal and interest costs may increase significantly once your introductory term has ended. Rate limitations restrict how much your interest rate can increase.

Jumbo Mortgage Loans

A jumbo mortgage loan is a type of mortgage that enables consumers to obtain loans for amounts above the federally set conforming loan limit. Jumbo loan rates can differ from conventional mortgage rates.

How to Get the Best Mortgage Rates

To increase your chances of getting the best mortgage rate, consider the following:

Improve your credit score. Mortgage lenders give individuals with good credit their lowest rates. Work to improve or maintain your score well before submitting an application for a mortgage by making on-time bill payments and reducing your credit utilization ratio, which is the proportion of your available credit to your credit limit.

Keep track of your employment history. Lenders frequently favor borrowers with a minimum of two years of stable employment. If you’re self-employed or have substantial gaps in your employment history, you should submit more documentation to be accepted for the best rate.

Increase your down payment savings. Securing a cheaper rate may be possible with a larger down payment. Automatically setting aside a percentage of your paycheck into a savings account is one approach to increasing your savings. Research down payment assistance programs is another option.

Compare mortgage rates. According to Freddie Mac research, shopping around for the best mortgage deal can result in significant savings for a 30-year loan. Consider obtaining an FHA loan if your credit rating isn’t as high as you’d like. When compared to a traditional loan, FHA loans can occasionally offer interest rates that are half a point or lower.

Consult a Mortgage Broker: A broker may assist you in finding the best offer and negotiating lower rates, and many don’t charge any fees.

Pay points: You can pay a supplementary fee, called a point, to lower your interest rate if you plan to stay in the house for a considerable amount of time and won’t refinance for a minimum of five years. Typically, each point costs 1% of the loan balance and lowers the interest rate by 0.25 points of percentage.

Bottom Line

The mortgage interest rates influence your home loan’s monthly and yearly costs. Getting the lowest rate is so essential. The best ways to achieve that include constantly comparing rates, improving your credit score, and thinking about engaging with a mortgage broker to find the best deals.

Leave a Reply